In today’s world, sustainability and eco-consciousness are more important than ever. While much of the conversation centers around what we consume, it’s time to consider how we pay for those goods and services. With the growing shift toward cashless transactions, a critical question arises: Are digital payments more sustainable and environmentally friendly than traditional payment methods?

The Hidden Environmental Cost of Traditional Payments

When thinking about environmental impact, payment methods often fly under the radar. Yet, traditional cash and coins come with significant ecological costs. Producing paper money consumes trees, water, and chemicals, while minting coins requires energy-intensive metal extraction and processing.

Even newer alternatives like polymer banknotes, which are praised for their durability and recyclability, still carry a high carbon footprint. According to Forbes, these plastic notes in the UK release more carbon dioxide during their lifecycle than their paper counterparts.

How Digital Payments Reduce Environmental Impact

Digital payments offer a more sustainable solution. One of their biggest environmental benefits is the reduction in demand for physical currency—no more printing, transporting, or disposing of banknotes and coins. As mobile wallets, online banking, and payment apps become more widespread, the need to carry physical cash or even plastic credit cards is quickly diminishing.

In fact, many consumers today prefer contactless and mobile payments for their speed and convenience. This shift is gradually phasing out the need to produce physical cards altogether—saving plastic and reducing waste.

Read about The Future of Payments in the UAE

Benefits for Businesses and Consumers Alike

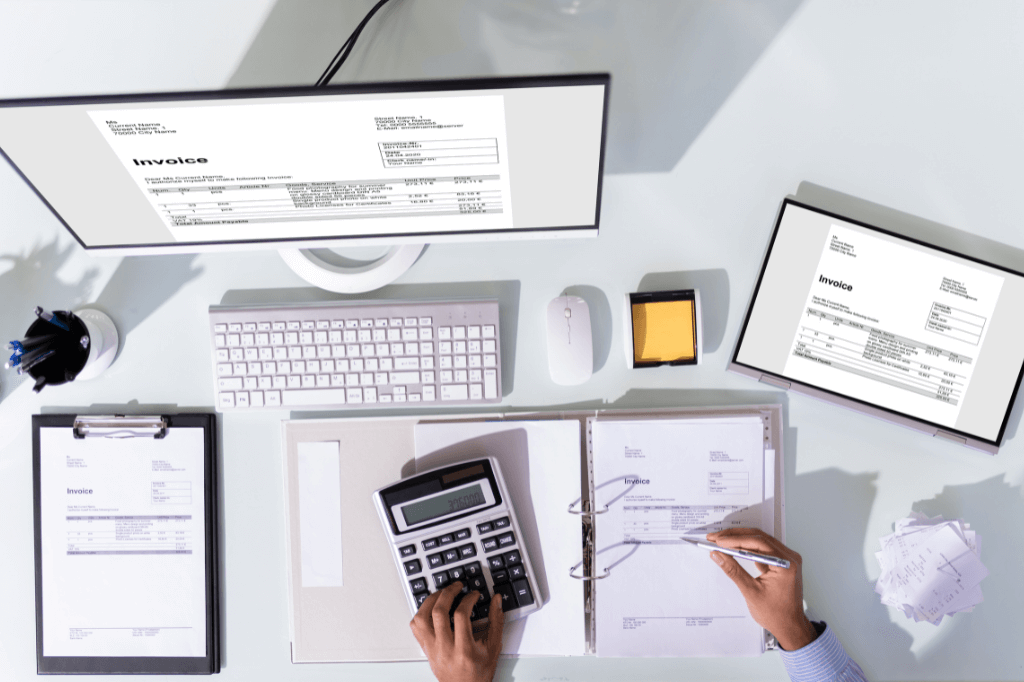

From an operational standpoint, businesses that adopt digital payment systems enjoy lower costs, faster transactions, and valuable data insights. These advantages not only streamline operations but also contribute to a more sustainable business model by reducing reliance on paper receipts, cash drawers, and other physical infrastructure.

For consumers, digital payments offer ease and safety. With the rise of contactless technology, especially after the COVID-19 pandemic, people increasingly prefer methods that reduce physical contact and risk. This growing demand supports the transition toward green payment solutions.

Potential Environmental Trade-Offs

Of course, it’s important to acknowledge the environmental concerns associated with digital payments. The production and disposal of electronic devices—such as smartphones, wearables, and point-of-sale (POS) machines—can contribute to electronic waste. Additionally, the rise of cryptocurrency mining raises concerns due to its high energy consumption.

However, these challenges are not exclusive to digital payments. Devices used for payment serve many other functions, and digital transactions do not necessarily lead to an increase in hardware use or crypto adoption. Instead, they leverage existing technologies more efficiently.

The Future of Green Finance

As the global economy becomes more digitized, the payments industry is clearly moving toward a more sustainable and eco-friendly model. While no solution is without its challenges, the shift to digital payments presents an opportunity to reduce the environmental footprint of everyday financial transactions.

In conclusion, digital payments support a greener, more sustainable future, aligning with the growing movement toward responsible consumption. For both businesses and consumers, embracing electronic payments is not just a matter of convenience—it’s a step toward protecting the planet.