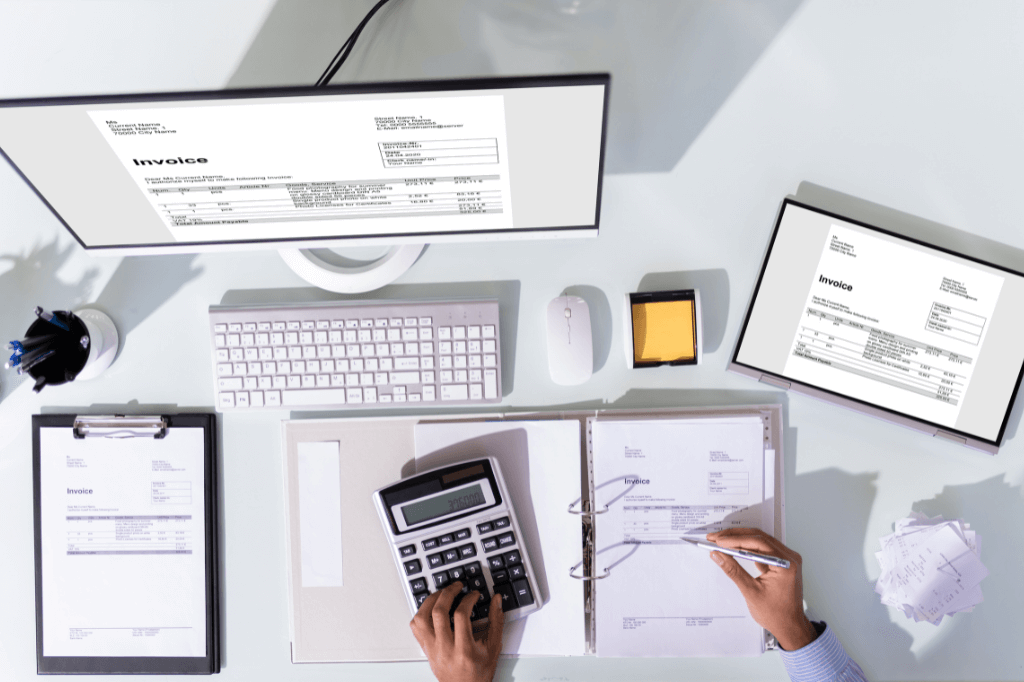

The idea of starting a business can happen overnight, yet many elements need to come together before an actual business can be born. From the day entrepreneurs first start their online store, to the first sale and all the way to the first major funding milestone, the rollercoaster never stops. One of the critical but often overlooked aspects of starting a business is the proper accounting and bookkeeping, which entrepreneurs often leave in an open Excel or till later in the business process when it becomes overwhelming.

What is accounting?

Accounting is the process of recording, classifying, and analyzing a business’s financial transactions. For online businesses, while customer data is often automatically captured, it’s essential to go beyond basic income tracking. Effective e-commerce accounting involves three key areas:

- Bookkeeping – Track and classify all income and expenses using an accounting system

- Tax Management – Track and remit all applicable taxes and file quarterly and year-end taxes

- Growth Planning – Gather all the financial information required to expand the business effectively

Here are some typical accounting terms entrepreneurs should know:

Purchase orders and sales invoices

Purchase orders are documents that show the amounts, values, and sources of goods purchased by the business that can later be resold or made into products, this also includes all tools used for service businesses such as design software licenses, etc. On the other hand, the sales invoices showcase what the clients bought, quantities and amounts paid, including accurate sales details such as customer information, description of goods and services, and delivery address.

Cost of products or services sold (COGS).

This stands for the cost of goods sold and refers to the full cost of producing and distributing a product or service. They include everything from direct and indirect costs involved in production such as the cost of production equipment and freight, but do not include overheads such as wages and marketing.

Cash flow

Cash flow is the movement of money in and out of business. This is also important in order to understand the time management of cash so that businesses would ideally get paid by clients before they have to pay for goods, something the cash flow statement clarifies. This is today easy to keep track of, thanks to advances in modern accounting software like Xero or Zoho Books, which automates cash flow management and helps entrepreneurs understand their financial obligations. Merchants can also link their accounting software to their bank accounts to monitor the inflow of money.

Gross profit and margin

Gross profit is the total revenue minus the cost of goods sold. Gross margin is expressed as a percentage of the total revenue.

The budget

This is the financial statement that shows the company’s assets, liabilities, and shareholders’ equity. It is one of the three main financial statements used to value a business

Profit and loss

Another key financial statement that provides an overview of a company’s profitability, is the profit and loss statement calculates total revenue minus all costs associated with the business. If this statement shows positive numbers, then the business is making profits and is generating more than the costs incurred. Alternatively, negative numbers mean the business is losing money.

Using online payment methods greatly helps maintain a digital record of the transactions of a business, especially at the early stages when the entrepreneurs are managing the financial aspects of the business directly themselves. Using cash is harder to trace, and recording and combining cash payments with digital methods (cards or bank transfers) could also open the door to errors and miscalculations. Either way, with 88% of UAE consumers using digital or online payment at least once to pay for goods or services, entrepreneurs in the UAE should always have an online payment or digital payment account to meet client needs.

Simplify E-commerce Accounting with Paymennt.com

Managing your online store’s finances shouldn’t be a headache. Paymennt.com offers a suite of tools to streamline your accounting and empower informed business decisions.

Free Online Store with Paymennt Shops:

- Effortlessly create a branded online store with Paymennt Shops – completely free!

- Gain a centralized hub to monitor and manage your finances seamlessly.

- Maintain a clear overview of your revenue and cash flow for effective financial planning.

Seamless Integration with Leading Accounting Software:

- Run your business finances efficiently with real-time insights and simplified recordkeeping.

- Connect your Paymennt online payment gateway to Xero or Zoho Books for effortless data transfer.

- Automatically log all transactions within your preferred accounting software, saving you valuable time.