From Freelancers To Retail Merchants, Why Payment Links Are A Gamechanger For Small Businesses

For many small companies, a sale could come at any hour of the day, on weekends, evenings and on holidays. While running a business as a single entrepreneur or with a small team has its own set of obstacles, the last thing merchants should be worried about is how to collect payments from their clients. While implementing a payment gateway on a website might be straightforward, it does need coding expertise, a fully fledged online store, and waiting weeks for an online payment account to be ready.

In addition, the expenses incurred in opening an online store and not having it being a main sales converting channel is rising fast, and these costs eat into the earnings of a small business. The pace of all things digital from ecommerce to bookings has increased dramatically in the past two years, and many small company owners and merchants are familiar with applications like WhatsApp and regular SMS, but many are unsure how to include payment solutions and give different payment choices for their customers. For the ones with little online presence beyond a facebook or instagram store, this is a major obstacle against being able to sell online.

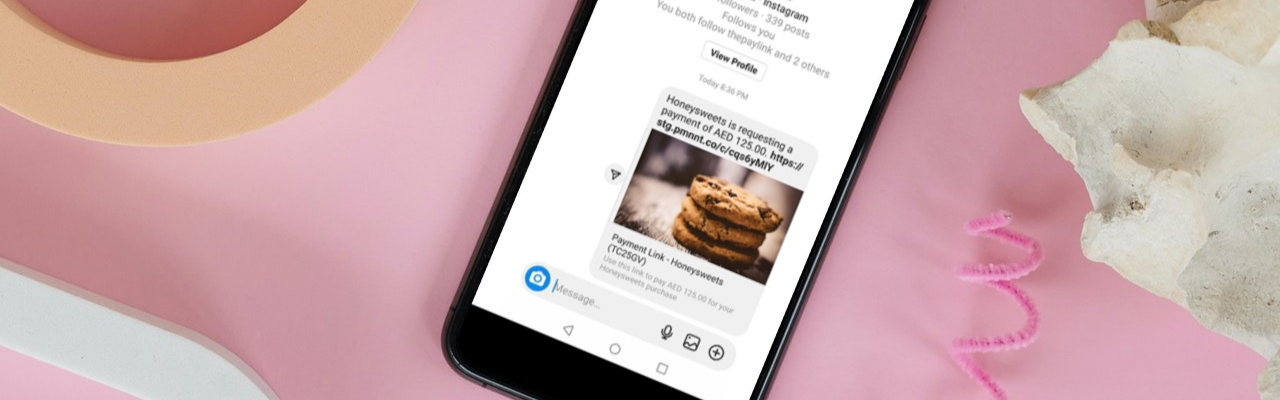

That’s where Paymennt payment links has helped thousands of merchants accept payment remotely over SMS, email, whatsapp without even an online presence, and in turn enabled them to grow their sales and revenue remotely.

Simple setup

Opening an account and generating a payment link with Paymennt is as easy as it gets, with only three steps: first creating the Payment Link using Paymennt app or web dashboard. Once the link is live, merchants share it via email, WhatsApp, SMS, or any other chosen chat network. The consumer in turn gets the link and chooses their preferred payment method to complete the transaction.

Ease of use

The paymennt app allows for the issuance of fixed or one time links from the same app. Fixed links can be shared in newsletters and paid multiple times, while one time links expire at payment. Merchants can also setup Subscription (recurring) payment links, which removes the manual work from repeat clients. In addition merchants can set payment link expiry, upload a file to send up to 50000 payment links at once, and have full tracking visibility on the payment process of clients.

Paymennt app 1-click refund feature also makes any returns and refunds much simpler than other platforms, hence streamlining the operations for business owners without the hassle of using forms.

Operationally easy to use

With Paymennt Payment Links, merchants can be up and running fast and have a reliable tech partner to take care of the rest. Among the benefits that set it different from the competitors are:

* A fully digital onboarding process, add the company details from the app and start right away

* Auto payment and settlement option into merchant accounts

* Fully mobile based experience, with no clunky websites or difficult dashboards

* Multiple terminal option so the entire team can work on the same account with multiple access levels

* PCI-DSS compliance for real-time risk identification and fraud prevention technologies to provide bank-grade security

Who are payment links good for?

Retail

Customers are already accustomed to receiving household products of various kinds and sizes delivered to their homes. Accepting cash or cash on delivery, on the other hand, might result in transportation and other concerns for low-ticket products, whilst customers prefer to pay using credit or debit cards for both high and low ticket items.

Paymennt Payment Links enables merchants to effortlessly accept online payments by just providing a link before delivery, removing all risks of canceled orders or not being able to get paid post delivery.

Freelancers

Freelancers benefit from freedom, but collecting money is always a challenge. Whether it’s physically requesting clients for payments or disclosing personal bank account information to accept payments or catering to diverse payment preferences by each customer, freelancers aren’t wrong to believe they’re on the receiving end of money. Thankfully, businesses can now offer their clients a Paymennt payment link to get paid on time without having to construct and manage a complete website. Also, enjoy sending payment reminders automatically. No more humiliating paper reminders!

Social media sellers

While people from both major cities and small communities are using social media platforms to make purchases, controlling the money side of things is more difficult than ever. Thankfully, Paymennt Payment Links can help you overcome this issue without having to limit your orders to cash on delivery or create a separate website to handle payments. Manage payments from a single dashboard and control your finances from a simple app.

Educational institutions

Educational institutions can create bulk payment links and distribute them to parents and students at once, allowing them to pay from the comfort of their own homes. Furthermore, by using Paymennt Payment Links, institutions can provide parents with the opportunity to pay using their favorite payment method, Visa, Mastercard, Apple Pay or buy now pay later options.

Restaurants and foodstuff traders

Perhaps one of the most compelling use cases pf payment links is in the Food and Beverage industry. Restaurants, caterers, sweet shops, bakeries, and party platter companies all use payment links to get paid in advance for their items, and make the delivery much more flexible. This is especially important when items need to be prepared beforehand to avoid last minute cancellations, and at the same time have the different team members manage the payments using multiple terminals.

These are just a few of the businesses that might benefit from Paymennt Payment Links, with many more applicable use case in other industries. Sign up now to be able to send payment links for your business using Paymennt.com

- Tags:

- Payment links

related articles

here’s what we've been up to recently.

What are Payment Links: An easy way to accept payment online

4 trends driving the success of local retailers in 2022

4 Payment Trends in 2022 to help you adapt to the pandemic.