As artificial intelligence (AI) continues to revolutionize the financial and payments industry, it brings with it both transformative benefits and unprecedented risks. While AI-powered payment systems can improve efficiency, personalization, and fraud detection, they also open the door to sophisticated forms of cybercrime. In this article, we explore the growing risks of AI in payments and how merchants can protect their businesses.

Why AI in Payments Is a Double-Edged Sword

AI systems are becoming more advanced in how they interpret data, mimic human behavior, and automate tasks. In payments, this means faster processing, better customer experiences, and stronger analytics. However, in the wrong hands, the same tools can be used to exploit vulnerabilities.

Cybercriminals are now using generative AI tools to create highly realistic content that can impersonate real people or institutions. This kind of AI misuse is particularly dangerous in financial systems where trust and verification are essential.

1. Impersonation: A New Threat to Payment Authentication

One of the most alarming risks of AI in payments is impersonation. With the rise of AI-generated voices and deepfake videos, scammers can convincingly mimic the identity of business executives, employees, or even customers.

Voice-based and video authentication systems are increasingly under threat. For instance, a fraudster could use an AI tool to replicate a CEO’s voice and authorize a high-value payment, or impersonate a customer requesting a bank transfer. These attacks are difficult to detect and can lead to severe financial losses.

How to Protect Your Business:

- Use multi-factor authentication (MFA) for sensitive transactions.

- Avoid relying solely on biometric or voice authentication.

- Train employees to identify suspicious or unusual requests.

- Set up alerts for high-risk activities, such as large fund transfers.

2. Anonymity: AI Fraud Without a Trace

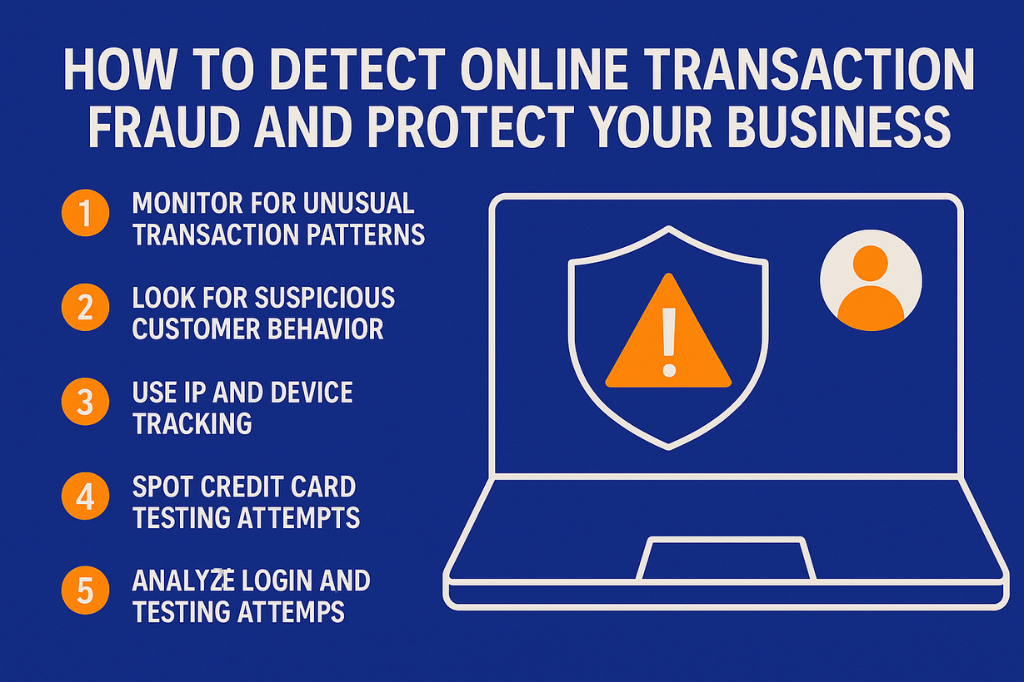

Unlike traditional fraud, AI-based scams often lack a human trace, making it harder for law enforcement to identify the perpetrators. AI bots can execute scams autonomously, such as credit card testing fraud—a tactic where attackers test thousands of card numbers at once to identify valid ones and drain compromised accounts.

These attacks can happen at scale, and because the AI itself is performing the fraud, there may be no identifiable human fingerprints on the activity.

Example:

A business could experience hundreds of small test transactions within minutes, each under the radar of traditional fraud detection tools. By the time it’s detected, the damage is done.

How to Mitigate the Risk:

- Implement Strong Customer Authentication (SCA) for high-value or suspicious transactions.

- Use in-app passcodes, biometric scans, and IP tracking.

- Monitor unusual transaction patterns or location mismatches.

- Leverage fraud detection tools powered by AI to fight AI-based attacks.

3. AI-Generated Phishing and Scam Automation

AI can also automate phishing emails, fake websites, and chatbot scams that trick users into entering payment details or confirming transactions. These outputs can closely resemble legitimate communications, making them even more effective.

As text, voice, and visuals generated by AI become indistinguishable from authentic content, payment security systems must evolve to detect these threats in real time.

Read how to protect your business by understanding online transaction fraud, its warning signs, and actionable prevention strategies to avoid financial losses and reputational damage

Best Practices for Securing AI-Driven Payment Systems

To safeguard your business from AI-related payment fraud, consider the following:

- Educate your team on how to recognize AI-generated fraud attempts.

- Stay updated with the latest fraud trends in digital payments.

- Use AI defensively: Modern fraud detection systems also rely on AI to spot anomalies and flag suspicious behavior.

- Layer your defenses: Combine authentication methods, transactional analytics, and behavioral analysis.

- Collaborate with your payment service provider to ensure they have robust AI-risk protocols in place.

Final Thoughts

As AI technology evolves, so do the risks associated with it—especially in the payments sector. From impersonation attacks to anonymous scams, the threats are real and growing. However, with proactive security strategies, strong authentication, and constant vigilance, businesses can stay one step ahead.