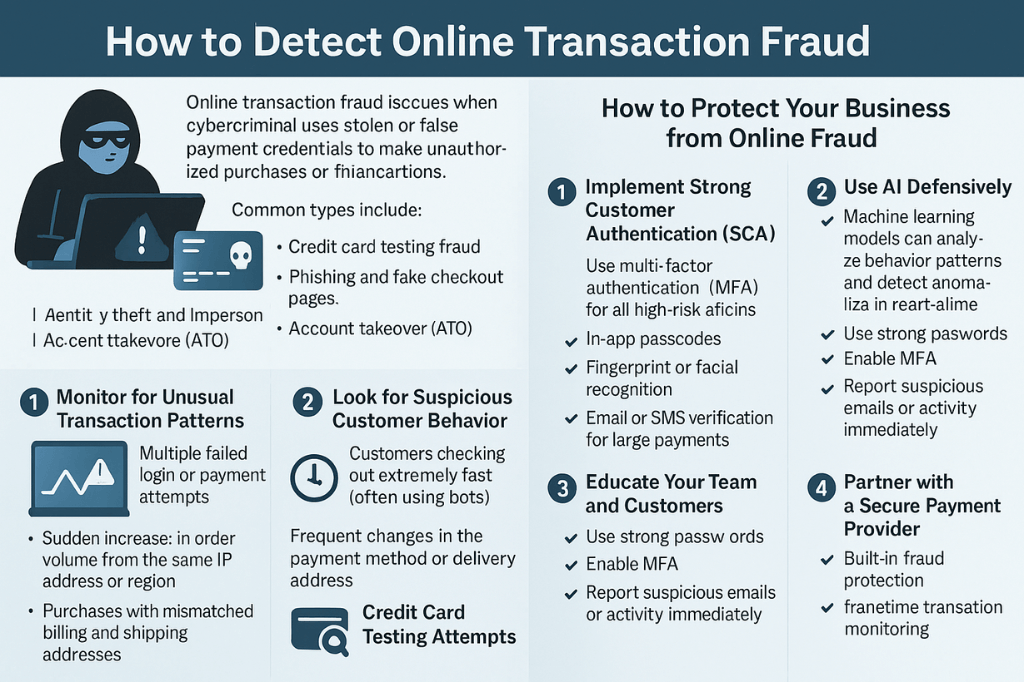

Online transaction fraud occurs when a cybercriminal uses stolen or false payment credentials to make unauthorized purchases or financial transactions. These transactions often go undetected until the damage is done, resulting in lost goods, chargebacks, and damage to your brand’s reputation.

Common types include:

- Credit card testing fraud

- Phishing and fake checkout pages

- Identity theft and impersonation

- Account takeover (ATO)

- AI-generated scam automation

How to Detect Online Transaction Fraud

1. Monitor for Unusual Transaction Patterns

Keep an eye out for:

- Multiple failed login or payment attempts

- Sudden increase in order volume from the same IP address or region

- Purchases with mismatched billing and shipping addresses

- High-value transactions from new customers

Tip: Use analytics tools or AI-powered fraud detection systems that can flag abnormal behavior in real-time.

2. Look for Suspicious Customer Behavior

Behavioral red flags include:

- Customers are checking out extremely fast (often using bots)

- Using multiple cards in a single session

- Frequent changes in the payment method or delivery address

These could indicate automated or scripted fraud attempts, especially with AI bots.

3. Use IP and Device Tracking

Geo-location and device fingerprinting can help detect if a transaction is coming from a high-risk or unexpected region.

- Use fraud tools that track IP address anomalies.

- Block transactions from flagged locations or known fraud hubs.

4. Spot Credit Card Testing Attempts

In credit card testing fraud, attackers make small transactions to check if stolen card details work. Look for:

- Many low-value transactions within minutes

- Different card numbers from the same IP/device

Preventive Step: Limit the number of payment attempts per session and monitor transaction velocity.

5. Analyze Login and Access Patterns

Monitor for:

- Logins from multiple countries in a short time

- New devices accessing old accounts

- Sudden password resets or data changes

These signs often point to account takeover (ATO) fraud, where a hacker gains unauthorized access to a customer’s account.

How to Protect Your Business from Online Fraud

Now that you can identify the signs, here’s how to build stronger defenses:

1. Implement Strong Customer Authentication (SCA)

Use multi-factor authentication (MFA) for all high-risk actions:

- In-app passcodes

- Fingerprint or facial recognition

- Email or SMS verification for large payments

2. Use AI Defensively

While AI poses risks, it also plays a key role in fraud detection:

- Machine learning models can analyze behavior patterns and detect anomalies in real-time.

- AI tools can block suspicious transactions automatically before they are processed.

3. Educate Your Team and Customers

Train your team to recognize phishing, social engineering, and impersonation scams. Encourage customers to:

- Use strong passwords

- Enable MFA

- Report suspicious emails or activity immediately

4. Partner with a Secure Payment Provider

Use a payment gateway that offers:

- Built-in fraud protection

- Real-time transaction monitoring

- Chargeback management

- PCI-DSS compliance

This ensures you’re not alone in fighting fraud—your provider has your back.

Final Thoughts

Online transaction fraud is evolving—but so can your defenses. With the right tools and strategies in place, you can detect fraud early, protect your business, and build trust with your customers.

Want to know more about how AI is changing the payments landscape?